Keywordsfree trade trade war U.S. protectionism

JEL Classification B10, F10, F13

Full Article

1. The Benefits of Free Market

Trade is beneficial to all the parties involved, as it is an agreement of will from which everybody wins. Inequality between people in terms of skills, knowledge and resources requires exchange as a necessity. Trade creates a vast market, increases total production, intensifies specialization and thus, increases productivity. A burning topic today is the freedom of international trade, namely the degree of intervention of the state in the economy. The free market is one of the fundamental values of liberalism and free trade is part of it. The motto of the Physiocrats "laissez faire et laissez passer, le monde va de lui même", has enlivened many liberal spirits in the years to come, and paved the way for the economic initiative. Starting from the Physiocrats values and the fruit of the thinking of the Scottish enlighteners, Adam Smith set forth the famous "invisible hand theory", encouraging the spontaneous and unrestrained actions of individuals. According to his theory, with the help of the "invisible hand", pursuing his own interest, the individual frequently promotes the interest of the society more effectually than when he really intends to promote it (Smith, 2007). His conviction is that individual action is the one that unintentionally creates wealth and not the state's efforts. The "invisible hand" of the free market will ensure, without any external intervention, redistribution of the assets necessary for life, generating prosperity and balance.

According to the absolute advantage theory, developed by Smith, countries should specialize in making those goods that they can produce more efficiently than others, never to attempt to make at home what it will cost more to make than to buy (Smith, 2007). By specializing, the workforce will become more skilled, produce more products at lower costs, save time and provide incentives for developing more efficient working methods. If a country has an absolute advantage in several areas, or in none, according to David Ricardo's comparative advantage theory, in order to win, it must concentrate its resources on the goods that it can produce most efficiently and import the others (Ricardo, 2001). In other words, nations will use their resources to produce goods at competitive costs using the revenue thus obtained to buy goods that they could produce at higher costs. Both theories support an increase in production through free trade. The free-market mechanism adjusts on its own with the help of the "invisible hand", succeeding, as Smith claims, to respond to market demands and "always supply us with the wine which we have occasion for" (Smith, 2007). Any interference from the state in the market mechanism is perceived by liberals as a risk that can distort the allocation of resources and diminish national income.

The harmonization of the individual's personal interest with the general interest of society can only be achieved if the market is left free and if there is competition. Competition is part of life, it manifests itself in all areas, and economy is no exception. Competition is perceived by free market proponents as the only way in which individuals' activities can be adapted to each other without coercive or arbitrary intervention by the authorities (Hayek, 2006). Competition will temper selfish motivations inherent in human nature, ultimately producing desirable social results. Liberals believe that on the market, the true sovereigns are the consumers, the entrepreneurs being just their servants bound to comply with their wishes (Mises, 1998). In order to achieve his goal and maximize the profit, the entrepreneur has to meet the needs of consumers with quality products at the lowest prices. Without conscious action, competition between individuals will stimulate the progress of both citizens and the nation as a whole. Competition reveals its true potential in the presence of freedom, the state's intervention risks to lead to discriminatory treatment, favoritism, and ultimately affect the performance of the economic system.

Along with competition, another key element for the proper functioning of the "invisible hand" is the free movement of prices. The market rewards all participants, irrespective of their religion, political preferences or nationality, the only criterion that matters is the price and quality of the goods and services offered. The interests of citizens and, above all, consumers are best pursued in a free market where the price is determined on the basis of the interaction of demand and supply. The price influences the decisions of the market players, but in turn, it is influenced by their actions. Much more efficient and better informed than any existing form of planning, the free price system is the most credible means to improve the standard of living of individuals. The market prices tell the producers what to produce, how to produce, and in what quantity (Mises, 1998).

According to the liberal doctrine, the economic order takes place between two extremes: the maximum of freedom and the minimum of state. The market has its own and very efficient mechanism after which it works, any interference from the state risks to deregulate this mechanism and affect the good functioning of the economy. The role of the state is limited to respecting the laws, protecting the rights and freedoms of individuals, protecting private property, and ensuring peace, so that the individual can manifest himself freely within the legal framework (Mises, 2012). Once the legal framework is secured, the actions of individuals are carried out freely without a specific command, and Adam Smith's "invisible hand" creates order, harmony and diversity throughout society. In other words, acting in their own interest and pursuing the satisfaction of their own needs, each individual will act naturally in the interests of others. Without external interference or coercive pressures on the part of the state, but in an organized legal framework, each citizen will contribute to helping the other and to the progress of society. Liberal principles in economics—the "free market"—have spread, and have succeeded in producing unprecedented levels of material prosperity, both in industrially developed countries and in countries that had been, at the close of World War II, part of the impoverished Third World (Fukuyama, 1992).

Nowadays, the proof of the free market benefits is the People's Republic of China. China has a specific state capitalism in which economic activity is controlled and managed by the state but it had taken very important steps towards liberalizing its economy. After a period of over 20 years of autarchy, the country's leadership has realized that opening its market to the world is the path to success. The adoption of free market principles since the 1970s took millions of people out of poverty and led to the country’s unprecedented economic development. Nowadays China is the second largest economy in the world, after the U.S. in terms of GDP and the world leader in terms of exports. China offers great opportunities to investors in terms of consumer demand, labor productivity, market potential, etc. so tens of thousands of foreign companies invested in China and earned substantial profits. In 2018, China continued to be the largest FDI recipient among developing countries and the second largest in the world, behind the United States. Due to the liberalization plans, China’s total FDI reached an all-time high of $139 billion, which contributed significantly to the countries progress (UNCTAD, 2019).

2. The U.S. Protectionist Past

Despite free-trade benefits, governments intervene in trade to attain economic, social or political objectives. The U.S. is considered to be a symbol of freedom worldwide, but in the past it was a very protectionist country. In 1789 the U.S. was a newly created country with a developing economy, heavily relying on other countries. That year, the first major piece of legislation signed by President George Washington was the Tariff Act. The Congress imposed a 5-percent-ad-valorem duty on most imported goods in order to encourage and protect the domestic manufactures. This initial tariff bill didn’t prove to be too effective as the nation as a whole exhibited little interest in using tariffs to stimulate manufacturing at home (Dobson, 1976). The protectionist approach continued the following years with the Tariff of 1828, which raised rates on manufactured goods, to as much as 50 percent, the highest level ever recorded. It was designed to protect industries in the northern United States, but it harmed directly the southern states which called the law the "Tariff of Abominations". The tariff was extremely controversial and contributed to the split between North and South.

In 1922, Fordney-McCumber Act, a bill perceived as both punitive and protectionist, raised the average import tax to some 40 percent. Its objective was to protect factories and farms and provide jobs to veterans from World War I. In the context of the outbreak of the Great Depression, the U.S. government appetite for protectionist measures has increased. In 1930, it promulgated the Smoot-Hawley Tariff Act, which raised the average tariff by some 20 percent to protect American businesses and farmers. The major trading partners decided to call for similar measures with repercussions on global trade. U.S. imports from and exports to Europe fell by some two-thirds between 1929 and 1932, while overall global trade declined by similar levels over the four years that the legislation was in effect. (Encyclopædia Britannica, 2018) Trust in the free market has been strongly shaken after the Great Depression of 1929-1933. Easy access to the market and the players' selfish intentions, have made businesses become a pawn on the chessboard for speculators, affecting the whole society. The U.S. witnessed record levels of unemployment, and the liberal doctrine proved incapable of providing a solution. The new reality appealed to another logic of development and to a new economic policy, aimed at reforming the system from a social point of view.

Keynes identifies Wall Street failure from 1929-1933 with the failure of the "laissez-faire" principle applied in practice and calls for state intervention to regulate the U.S. stock market. Convinced that the market is not capable of balancing alone and overcoming crisis times, he suggests that the first step has to be taken on the initiative of public authority and it has to be on a large scale and organized with determination. (Keynes 1933) Positioned between an economy based on the "laissez-faire" principle and a planned economy, it promotes an energetic state involved in the economy both during war and peacetime when the economy is facing difficulties.

Keynesian theory of demand stimulation and budget deficit has lost popularity since the 1970s recession. Reality has shown that unemployment and inflation can coexist, an economic phenomenon that has been called stagflation. In this context, in 1989 the U.S. government adopted a new economic policy framework known as Washington Consensus - a free-market economic policies. The policy pursued by President Ronald Reagan and the majority of Republican presidents who succeeded him, promoted the freedom of action of the individual, the existence of a minimal state and a strong deregulation policy. According to Fraser Institute, in 2000, the U.S. ranked third in the world after Hong Kong and Singapore in terms of economic freedom. Forty-two variables are used to construct the Economic Freedom of the World index and measure the degree of economic freedom in five broad areas: size of government, legal system and property rights, sound money, freedom to trade internationally and regulation. (Fraser Institute) At the beginning of the 21st century, the U.S. was considered a standard of economic freedom among the big industrialized countries. It encouraged free initiative and competitive spirit as a powerful incentive for entrepreneurship and innovation. The primary form of ownership was private, and consumer and producer decisions had the greatest influence in the U.S. economic mechanism.

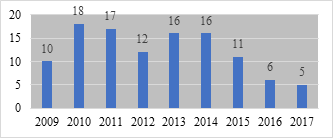

However, the 2007-2008 financial crisis has shaken again the liberal values based on free trade and the state began to make its presence felt more and more in the economy. In the face of the new realities, the U.S. government has been forced to choose between two alternatives: to take no position and risk the collapse of the entire financial and economic system, or to inject trillions of taxpayers’ dollars into the financial system and beyond. Without leaving Joseph Schumpeter's "Creative Destruction" (Schumpeter, 2003) to take over the market, the government has decided to support banks, insurance companies and auto companies that have been affected by international competition. Even though state interventions have proved to be the only way to avoid the deepening recession and revive the economy, they have significantly affected the free market mechanism and led to the downgrading of the U.S. in the top of economic freedom. During 2009 – 2015, due to the expanded use of regulation, the U.S. score continued to decline in all five areas of the Economic Freedom of the World index (EFW). Only in 2016 the U.S., finally managed to return to the top 10, reaching the sixth position.

Figure 1. U.S. rank in the world in terms of economic freedom

Source: Fraser Institute

In 2008, at the meeting of the G20 leaders, one of the subjects on the agenda was to reject protectionism and to refrain from raising new barriers to investment or to trade in goods and services, imposing new export restrictions, or implementing WTO inconsistent measures to stimulate exports (OECD, 2008). Exports and imports are essential components of the global economy and contribute significantly to economic performance. The fear was that after the dramatic collapse of international trade due to the 2007-2008 financial crisis, governments may protect their economies by increasing tariffs and using other trade barriers.

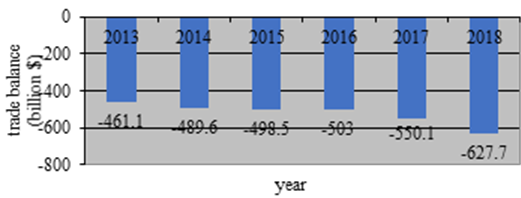

Starting with 2008, the U.S. average tariff rates registered a downward trend, so in 2016 it was the lowest in the world, recording the value of 1.67%. It seemed that the politicians have learned from the lessons of the past, and they did not want to repeat them again. However, between 2009 and 2017, the United States has implemented the largest number of non-tariff barriers, close to 800. The country has made extensive use of discriminatory state aid measures and subsidies, as well as public procurement policies. It accounts for more than 70% of all worldwide public procurement policies and about 25% of all subsidies and state aid barriers. Within this time frame, 17.2% of imports into the United States faced at least one non-tariff barrier (Yalcin et al., 2017). Despite these measures, in the last 6 years, the U.S. trade deficit has deepened, reaching a record high of $627.7 billion in 2018.

Figure 2. U.S. net trade in goods and services 2013 – 2018

Source: The World Bank, Data

3. Protectionism on the Rise in the U.S.

Through the Reciprocal Trade Agreement Act, passed in 1934, the U.S. Congress empowered the President to negotiate international agreements and to modify tariffs under certain circumstances. Due to these prerogatives, President Donald Trump has decided to turn from free and open trade toward so-called fair trade based on "America first" policy. Thus, he adopted a number of protectionist measures in order to revitalize the country's economy and reduce the trade deficit. His ideas have been communicated since the election campaign, and the fact that he was elected is proof that his nationalist vision was shared by a large part of the U.S. population.

Similar to mercantilist principles, U.S. protectionism regards world trade as a game with winners and losers measured in terms of their trade balances (Park, 2018). Becoming critical of free trade agreements, the first action taken by President Trump was to abandon the Trans-Pacific Partnership (TPP). According to this agreement, the U.S., together with 11 more Pacific coastal countries, were to lower both non-tariff and tariff barriers, in order to intensify trade between signatories. The deal was negotiated by former President Barack Obama and aimed at increasing the U.S. presence in the Asia-Pacific region where China's influence is very high. Obama hoped that TPP will make it easier for American companies to sell Made in America products across the other countries in the agreement by eliminating more than 18,000 taxes and trade barriers on American products. (The White House, 2015) TPP could have been a way to strengthen the U.S. economy and support higher-paying American jobs, but President Trump had another opinion. He withdrew the U.S. from the TPP, fearing that unemployment will rise as companies decide to outsource production to developing countries. This decision has frustrated many farmers, businesses, ranchers, and exporters who believed that the agreement would have helped them grow and support their workers. While some industries benefit from this decision, others suffer major losses.

Another commercial deal in danger of being canceled was The North American Free Trade Agreement (NAFTA). Donald Trump threatened Mexico and Canada that the U.S. will leave the deal if he will not obtain better conditions for his country. Trump was in a strong negotiating position as the U.S. is very important for its partners for both exports and imports. The presidents of the three countries signed on November 30, 2018 a new United States-Mexico-Canada Agreement (USMCA) meant to increase environmental and labor regulations, provide strong protection and enforcement of intellectual property rights, promotes stronger measures on digital commerce and stimulate more domestic production of cars and trucks. (The White House August 2018) It is in the interest of all the member countries for the new agreement to be ratified as researches have shown that trade among geographically close countries is likely to rise by 330 percent once an agreement is established. The reason is that it increases the market size, goods travel on a shorter distance, consumer’s taste are likely to be similar and distribution channels can easily be established. (Daniels et al., 2017) For the U.S., trade with Canada and Mexico supports nearly 14 million American jobs, and nearly 5 million of these jobs are supported by the increase in trade generated by NAFTA. (U.S. Chamber of Commerce, 2017) The U.S. producers benefit from the large and growing Mexican market while companies can establish manufacturing facilities in Mexico to take advantage of low cost labor and offer the consumers cheaper products on the common market.

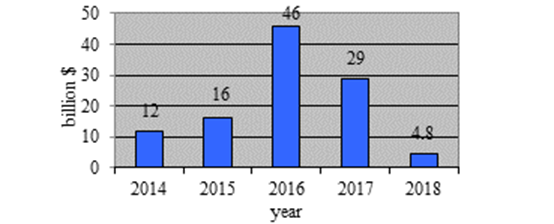

While other countries open their economies to the world, the United States is closing its more and more. In 2018 Trump signed the Foreign Investment Risk Review Modernization Act (FIRRMA), meant to expand the jurisdiction and the timelines of the Committee on Foreign Investment in the United States (CFIUS) (U.S. Department of the Treasury, 2018). CFIUS will have more time and power to review the national security implications of foreign investments in the U.S. companies or operations. Even if there is no direct reference to a particular country, it seems that the intent of the law is to give CFIUS greater power into a range of Chinese investment in the United States. The U.S. wants to contest China's unfair trade and economic practices and restrict its acquisition of sensitive technologies. The U.S. fears that the Chinese investments and merger deals are meant to steal technologies and gain access to sensitive data that could endanger national security. In early 2018, CFIUS blocked the Chinese Ant Financial's plan to acquire U.S. money transfer company MoneyGram International Inc, for $1.2 billion. The same year, a Chinese investment firm, backed by state-owned Sino IC Capital, abandoned a $580 million transaction to acquire the U.S.–based semiconductor testing equipment provider Xcerra, as CFIUS was about to reject the deal. According to the estimates made by Rhodium Group's researchers, Chinese investors abandoned deals worth more than $2.5 billion in the US in 2018 due to unresolved CFIUS concerns. (Hanemann et al., 2019). The tensions between the two sides have not stopped there, as in May 2019 the Chinese technology giant Huawei Technologies Co., Ltd. (Huawei) and sixty-eight of its non-U.S. affiliates were added to the U.S. Department of Commerce's "Entity List". The Department reached the conclusion that the company was engaged in activities that were contrary to U.S. national security or foreign policy interests. Being on the "Entity list", the Chinese company is subject to specific license requirements for the export, re-export and/or transfer (in-country) of any item subject to the Export Administration Regulations (EAR) (Federal Register, 2019). CFIUS regulations and the deteriorating political relationship between the two countries were the main culprits of the collapse of Chinese investments in the U.S., to the lowest level in the past seven years.

Figure 3. Chinese investments in the U.S. 2014 -2018

Source: Hanemann, Gao 2015; Hanemann, Gao 2016; Hanemann, Gao, Lysenko January 2019

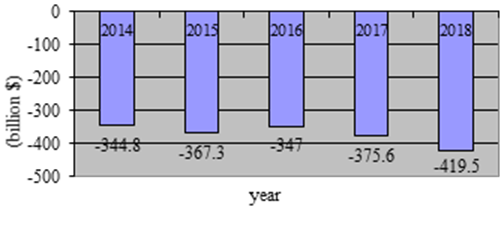

Another thing that fuels tensions between the U.S. and China is the trade deficit. Trump administration accuses China of pursuing industrial policies and unfair commercial practices such as dumping, non-tariff discriminatory barriers, forced technology transfer, overcapacity, and industrial subsidies, which favors Chinese firms and make it impossible for many U.S. companies to compete on fair ground (The White House May, 2018). Because Chinese imports have become preferred to domestic industry, some local businesses are strongly affected. Much of the imported goods are from U.S. manufacturers that send raw materials to China for low-cost assembly, so when finished products return to the country they are registered as imports.

Figure 4. The U.S. – China trade deficit 2014 - 2018

Source: (Buchholz K, Statista 2019)

During the year 2018 the US implemented a series of trade measures to reduce imports for steel, aluminum, solar panels and washing machines but soon after, it specifically targeted imports from China. The reason was that in the same year the Office of the United States Trade Representative (USTR) found out after an exhaustive investigation that China’s acts, policies and practices related to technology transfer, intellectual property and innovation are unreasonable and discriminatory and burden or restrict U.S. commerce. This has proven to be the beginning of a disastrous trade war with significant global repercussions.

Table 1. U.S. – China additional tariffs

| US additional tariffs on Chinese products | China’s additional tariffs on US products | ||||||

| Date | Trade Value | List | Tariff rate | Date | Trade Value | List | Tariff rate |

| July 6, 2018 | $34 billion | List 1 | 25% | July 6, 2018 | $34 billion | List 1 | 25% |

| August 23, 2018 | $16 billion | List 2 | 25% | August 23, 2018 | $16 billion | List 2 | 25% |

| September 24, 2018 | $200 billion | List 3 | 10% | September 24, 2018 | $60 billion | List 3 | 5% to 25% |

| September 1, 2019 | $300 billion | List 4A | 15% - reduced to 7.5% | September 1, 2019 | $75 billion | List 4A | 5% to 10% |

| December 15, 2019 - no longer implemented | List 4B | December 15, 2019 - no longer implemented | List 4B | ||||

Source: USTR. China Section 301, The State Council. The People’s Republic of China

The outlook for 2020 is encouraging as US and China had serious and constructive discussions on related trade issues in the latter part of 2019. Both countries have published lists of products to be exempted from additional tariffs and on December 13, they have signed the Phase One Trade Agreement. According to this agreement, the US has agreed not to proceed with the tariffs scheduled to take effect on December 15 and to reduce the September 1 tariffs from 15 to 7.5 percent on approximately $120 billion of Chinese imports. On the other hand, China has made a firm commitment that it will make structural reforms and changes to its economic and trade regime and will make substantial additional purchases of U.S. goods and services in the coming years (USTR, 2019).Still, at the end of 2019, US has imposed tariffs on $370 billion worth of Chinese products, at a time when in 2018 US total imports from China were $557.9 billion (USTR, China 2018). U.S. politicians must not forget that the U.S. and China are dependent on each other for growth. China was the United States' largest supplier of goods and the 3rd largest goods export market in 2018. Also, U.S. companies have made great profits operating and manufacturing in China for decades and exporting goods and services. Even if some American industries are to benefit from the protectionist measures, many others will suffer. Restraining imports can harm U.S. workers and businesses that rely on free trade, or have integrated their production and supply chains globally. The companies’ competitiveness will be affected as well as U.S. consumers who will have to pay higher prices for the imports subject to tariffs. Overall, these measures can produce more harm than good, generating economic decline and unemployment. The prolongation of the trade war between U.S. and China can generate political tensions and negative effects on the global market.

The US protectionist measures have affected many other countries including those from the European Union. In order to protect the national steel and aluminum industry, Trump administration adopted safeguard measures, by imposing a 10 percent, respectively 25 percent ad valorem tariff on such articles imported from most countries, including the European Union (EU).As the U.S. steel and aluminum tariffs affect EU exports worth €6.4 billion in 2017, its leaders triggered a dispute settlement case at the WTO in order to protect the EU market. Consequently, EU applied additional duties of 10, 25, 35 and 50 percent on selected products originating in the United States valued at up to €2.8 billion of trade which came into effect on June 2018. The list of U.S. imports that face an extra duty at the EU border includes steel and aluminum products, agricultural goods and a combination of various other products. The remaining rebalancing on trade valued at €3.6 billion will take place in three years' time or after a positive finding in WTO dispute settlement if that should come sooner. These measures are in line with the World Trade Organization (WTO) rules and will be effective for as long as the U.S. measures are in place. (European Commission, 2018). Tensions between the two parties continued as the WTO decided in October 2019, after nearly 15 years of litigation, that US aerospace industry was harmed by the illegal subsidies given to Airbus company by European Union. Thus, the US was authorized to take countermeasures with respect to the European Union and certain member States (Germany, France, Spain, and the United Kingdom), at a level not exceeding $7,496.623 million annually (WTO, 2019). The tariff increases will be limited to 10 percent on large civil aircraft (Airbus) and 25 percent on agricultural and other products etc. Many European producers will be affected by these measures but also the US importers and consumers of those European products. Prospects are worrying, as president Trump threatens tariffs on cars and car parts imported from the EU by as much as 25%, as they are considered a threat to US national security. The U.S. and the EU have the largest bilateral trade relationship in the world in amount of nearly $1.3 trillion in 2018 of which exports totaled $575 billion and imports totaled $684 billion (USTR, EU 2018). These protectionist measures risk having a negative impact on the relations between the parties and on the global markets, culminating in political tensions. A US-EU trade deal could calm the waters, but neither in this respect the two parties agree, as the US wants to abolish tariffs for both industrial and agricultural goods, in contrast to the EU who seeks to limit the agreement to industrial products

4. Conclusions

The entire world wants China to adopt a fair trade attitude, to end subsidies and preferential treatment, reduce the power of the state-owned enterprises and treat companies equally. It is possible that China will make small changes on its industrial policies but it is hard to believe that it can produce a fundamental change to its economic structure in the near future. A prolongation of the US-China trade war it is not in anyone's interest and there are many studies that confirm this. UNCTAD warns that the tariffs imposed by US on China are economically hurting both countries, generating a sharp decline in bilateral trade and higher prices for US consumers. The study reveals that in the first half of 2019, the US tariffs caused China a 25% export loss of approximately $35 billion. Of the $35 billion Chinese export losses in the US market, about $21 billion was diverted to other countries, such as Taiwan and Mexico, while the remainder of $14 billion was either lost or captured by US producers (Nicita, 2019). A solution for these tensions not to escalate could be a trade agreement between US and China. Such an agreement would bring global macroeconomic benefits such as lower tariffs, a decline in policy uncertainty, easing of financial markets conditions, and structural reforms reducing underlying barriers to trade and investment (Cerutti et al., 2019).

With only a few exceptions, all the developed countries got rich and promoted their young industries by applying tariffs and quotas. The U.S. also used protectionist measures to turn from an agrarian economy into a world's largest industrial power. From Alexander Hamilton, U.S.’s original protectionist, politicians have identified those industries with real long-term growth potential and helped them develop. Protective measures may be beneficial in the short term, but if prolonged, they are likely to discourage trade and confer too much power to the state. No coercive measures and strict regulations will generate economic progress, but spontaneous cooperation of free market actors under a lawful system applied to all equally. A group of researchers from the National Bureau of Economic Research have concluded that the tariff revenue the US is collecting is no sufficient to compensate the loss felt by the consumers of imports as a result of rising prices. According to their estimates, the tariffs reduced real incomes by about $1.4 billion per month. Moreover, the trade war started by the US causes costly adjustments in international supply chains and reduces real income for the global economy as well (Amiti et al., 2019).

The state is an important actor on the free market scene and a positive factor of economic growth but only if its degree of influence is maintained within certain limits. If it exceeds its powers, risks obstructing or even blocking spontaneous cooperation between individuals. Using Adam Smith's concept of "invisible hand" in a very original way, Milton Friedman emphasizes the link between political power and corruption: "an individual intending to serve the public interest, favoring government intervention, is led by an "invisible hand" to promote the private interest, which was not his intention to do" (Friedman, 2009). Even though U.S. politician’s actions are well-intentioned, these measures risk to choke sooner or later the economy and encourage corruption among decision-makers. Powerful interest groups can put pressure on state leaders to adopt customs duties that serves their interests. Just as Adam Smith noticed "wanting to liberalize trade is a utopia ... because the personal interest of many individuals opposes this irresistibly" (Samuelson, Nordhaus 2001). The lobby made by the big industrial corporations has often influenced the U.S.'s policy of decision-making. History proved that the protectionist measures help a small group of companies / people to win, but on a long term the nation per total loses. Only in a free market where sellers and individual buyers compete to maximize their profits, can be achieved the "American Dream". Because of the growing influence of corporations on political governments, Americans are beginning to believe that their form of government no longer promotes the American dream. According to a report published in November 2019 by Allianz and Euler Hermes Economic Research, since the 2008 financial crisis the U.S. adopted 790 protectionist trade measures, more than any other country since (Allianz and Euler Hermes Economic Research, 2019).

Free trade enables countries to increase their production and consumption, thereby contributing to the increase of the living standard of all mankind. Unfortunately, in the U.S., free trade began to lose the struggle with economic protectionism, and national interest gained ground in front of economic cooperation.

References

- Allianz and Euler Hermes Economic Research, 2019. Global Trade Report [online] Available at: https://www.eulerhermes.com/content/dam/onemarketing/euh/eulerhermes_com/erd/publications/pdf/Trade-report-nov19.pdf [Accessed on 11 November 2019].

- Amiti, M., Redding, S. J. and Weinstein, D., 2019. The Impact of the 2018 Trade War on US. Prices and Welfare. National Bureau of Economic Research. DOI: 10.3386/w25672.

- Buchholz, K., 2019. The U.S.-China Trade Deficit is Growing. Statista. [online] Available at: https://www.statista.com/chart/15419/the-us-trade-balance-with-china/ [Accessed on 11 November 2019].

- Cerutti E., Chen S., Deb P., Gjonbalaj A., Hannan S.A. and Adil Mohommad A., 2019. Managed Trade: What Could be Possible Spillover Effects of a Potential Trade Agreement Between the U.S. and China?. IMF Working Paper. https://www.imf.org/~/media/Files/Publications/WP/2019/wpiea2019251-print-pdf.ashx [Accessed on 11 November 2019].

- Daniels, J., Radebaugh, L. and Sullivan, D., 2017. International Business. Environment & Operations. 16th Edition. New York: Pearson.

- Dobson, J., 1976. Two Centuries of Tariffs. The Background and Emergence of the U.S. International Trade Commission. U.S. Government Printing Office: Washington, D.C. [online] Available at: https://www.usitc.gov/publications/other/pub0000.pdf [Accessed on 11 November 2019].

- Encyclopædia Britannica, 2018. Smoot-Hawley Tariff Act. [online] Available at: https://www.britannica.com/topic/Smoot-Hawley-Tariff-Act [Accessed on 11 November 2019].

- European Commission, 2018. EU adopts rebalancing measures in reaction to US steel and aluminum tariffs. [online] Available at: http://trade.ec.europa.eu/doclib/press/index.cfm?id=1868 [Accessed on 11 November 2019].

- Federal Register, 2019. Addition of Certain Entities to the Entity List and Revision of Entries on the Entity List. Bureau of Industry and Security, Commerce. [online] Available at: https://www.federalregister.gov/documents/2019/08/21/2019-17921/addition-of-certain-entities-to-the-entity-list-and-revision-of-entries-on-the-entity-list [Accessed on 11 November 2019].

- Fraser Institute, 2018. Economic Freedom. [online] Available at: https://www.fraserinstitute.org/economic-freedom/map?geozone=world&page=map&year=2017&countries=USA [Accessed on 11 November 2019].

- Friedman, M., 2009. Free to choose. (Romanian version). Bucharest, Romania: Publica.

- Fukuyama, F., 1992. The End Of History and the Last Man. New York: Macmillan [online] Available at: http://aps-m.org/wp-content/uploads/2017/03/The-End-of-History-and-the-Last-Man-Francis-Fukuyama-1992.pdf [Accessed on 11 November 2019].

- Hanemann, T. and Gao, C., 2015. Chinese FDI in the United States: Q4 and Full Year 2014 Update. Rhodium Group [online] Available at: https://rhg.com/research/chinese-fdi-in-the-united-states-q4-and-full-year-2014-update/ [Accessed on 11 November 2019].

- Hanemann, T. and Gao, C., 2016. Chinese FDI in the US: 2015 Recap. Rhodium Group [online] Available at: https://rhg.com/research/chinese-fdi-in-the-us-2015-recap/ [Accessed on 11 November 2019].

- Hanemann, T., Gao, C. and Lysenko, A., 2019. Net Negative: Chinese Investment in the US in 2018. Rhodium Group. [online] Available at: https://rhg.com/research/chinese-investment-in-the-us-2018-recap/ [Accessed on 11 November 2019].

- Hanemann, T., Rosen, D.H., Gao, C. and Lysenko, A., 2019. Two-Way Street: 2019 Update US-China Direct Investment Trends. Rhodium Group. [online] Available at: https://rhg.com/research/two-way-street-2019-update-us-china-direct-investment-trends/ [Accessed on 11 November 2019].

- Hayek, F., 2006. The Road to Serfdom. (Romanian version). Bucharest, Romania: Humanitas.

- Keynes, J.M., 1933. The means to prosperity. London: Macmillan and Co.

- Mises, L., 1998. Human Action. A Treatise On Economics. Auburn, Alabama: Ludwig von Mises Institute.

- Mises, L., 2012. Liberalism: In the Classical Tradition. (Romanian version). Iasi, Romania: Alexandru Ioan Cuza University Press.

- Nicita, A., 2019. Trade and trade diversion effects of United States tariffs on China. UNCTAD Research Paper No. 37. [online] Available at: https://unctad.org/en/PublicationsLibrary/ser-rp-2019d9_en.pdf [Accessed on 11 November 2019].

- OECD, 2008. The 2008 G-20 Washington DC Summit. [online] Available at: http://www.oecd.org/g20/summits/washington-dc/ [Accessed on 11 November 2019].

- Park, S.C., 2018. U.S. Protectionism and Trade Imbalance between the U.S. and Northeast Asian Countries. International Organisations Research Journal, 13(2), pp.76-100. DOI: 10.17323/1996-7845-2018-02-05

- Ricardo, D., 2001. On the Principles of Political Economy and Taxation. Ontario, Canada: Batoche Books Kitchener.

- Samuelson, P. and Nordhaus, W., 2001. Economics. (Romanian version). Bucharest, Romania: Teora.

- Schumpeter, J.A., 2003. Capitalism, Socialism & Democracy. London, UK: Routledge.

- Smith, A., 2007. An Inquiry Into the Nature and Causes of the Wealth Of Nations. ΜεταLibri Digital Library [online] Available at: https://www.ibiblio.org/ml/libri/s/SmithA_WealthNations_p.pdf [Accessed on 11 November 2019].

- The State Council, 2019. The People’s Republic of China. [online] Available at: http://english.www.gov.cn/statecouncil/ministries/page_1.html [Accessed on 11 November 2019].

- The White House, 2018. President Donald J. Trump is Confronting China’s Unfair Trade Policies [online] Available at: https://www.whitehouse.gov/briefings-statements/president-donald-j-trump-confronting-chinas-unfair-trade-policies/ [Accessed on 11 November 2019].

- The White House, 2018. President Donald J. Trump is Keeping His Promise to Renegotiate NAFTA. Fact sheets. [online] Available at: https://www.whitehouse.gov/briefings-statements/president-donald-j-trump-keeping-promise-renegotiate-nafta/ [Accessed on 11 November 2019].

- The White House, 2015. Statement by the President on the Trans-Pacific Partnership. Office of the Press Secretary. [online] Available at: https://obamawhitehouse.archives.gov/the-press-office/2015/10/05/statement-president-trans-pacific-partnership [Accessed on 11 November 2019].

- The World Bank, 2019. World Bank Data [online] Available at: https://data.worldbank.org/ [Accessed on 11 November 2019].

- UNCTAD, 2019. World Investment Report 2019. New York: United Nations Publication [online] Available at: https://unctad.org/en/PublicationsLibrary/wir2019_en.pdf [Accessed on 11 November 2019].

- U.S. Chamber of Commerce, 2017. The Facts on NAFTA. Assessing Two Decades of Gains in Trade, Growth, and Jobs. [online] Available at: https://www.uschamber.com/sites/default/files/the_facts_on_nafta_-_2017.pdf [Accessed on 11 November 2019].

- U.S. Department of the Treasury, 2018. Summary of the Foreign Investment Risk Review Modernization Act of 2018. [online] Available at: https://www.treasury.gov/resource-center/international/Documents/Summary-of-FIRRMA.pdf [Accessed on 11 November 2019].

- USTR, 2019. China Section 301-Tariff Actions and Exclusion Process. [online] Available at: https://ustr.gov/issue-areas/enforcement/section-301-investigations/tariff-actions [Accessed on 11 November 2019].

- USTR, 2018. European Union. U.S.- EU Trade Facts. [online] Available at: https://ustr.gov/countries-regions/europe-middle-east/europe/european-union [Accessed on 11 November 2019].

- USTR, 2018. The People's Republic of China. U.S.-China Trade Facts. [online] Available at: https://ustr.gov/countries-regions/china-mongolia-taiwan/peoples-republic-china [Accessed on 11 November 2019].

- USTR, 2019. United States and China Reach Phase One Trade Agreement. [online] Available at: https://ustr.gov/about-us/policy-offices/press-office/press-releases/2019/december/united-states-and-china-reach [Accessed on 11 November 2019].

- WTO, 2019. European Communities and Certain member States - Measures Affecting Trade in Large Civil Aircraft [online] Available at: https://www.wto.org/english/tratop_e/dispu_e/cases_e/ds316_e.htm [Accessed on 11 November 2019].

- Yalcin, E., Felbermayr, G. and Kinzius, L., 2017. Hidden Protectionism: Non-Tariff Barriers and Implications for International Trade. Munich: Ifo Institute for Economic Research. [online] Available at: https://www.cesifo-group.de/DocDL/ifo_Forschungsberichte_91_2017_Yalcin_etal_Protectionism.pdf [Accessed on 11 November 2019].

Article Rights and License

© 2019 The Author. Published by Sprint Investify. ISSN 2359-7712. This article is licensed under a Creative Commons Attribution 4.0 International License.