Keywordsintegrate reporting nonfinancial reporting stakeholder systematic literature review

JEL Classification M49

Acknowledgements:

This work was co-financed from the European Social Fund, through the Human Capital Operational Program, project number POCU/380/6/13/123623 <

Both authors have equal contributions to the writing of the article.

Full Article

1. Introduction

The academic interest for studying the stakeholders and how they influence the performance in the business developed by an economic entity is highlighted by the large number of articles containing the keywords "stakeholder" and "performance". The interest of the economic entities, for adopting a non-financial reporting that reflects the performance of their business has reinforced studies that analyse the advantages/disadvantages of the types of reporting, a fact proven by the large number of articles including the keywords "non-financial reporting" and “integrated reporting”. Although there are plenty of guides for conducting such a literature review in other areas of research, I found that none fully responds to the unique needs of economic researchers and even less to accounting.

However, we chose this method of literature review, because it is a method that allows the study of scientific works in an in-depth manner, meant to provide critical reflections and future directions in our research (Massaro et al., 2016). According to Fink (2005), SLR can be undertaken to describe the knowledge available for professional practice, for identifying effective research projects and techniques, and for identifying experts in a particular field. A SLR examines and interprets all available and relevant research for a particular area of question or topic, proposing to present an evaluation of a topic in the research literature using a rigorous methodology (Beecham et al., 2007).

2. Research Methodology

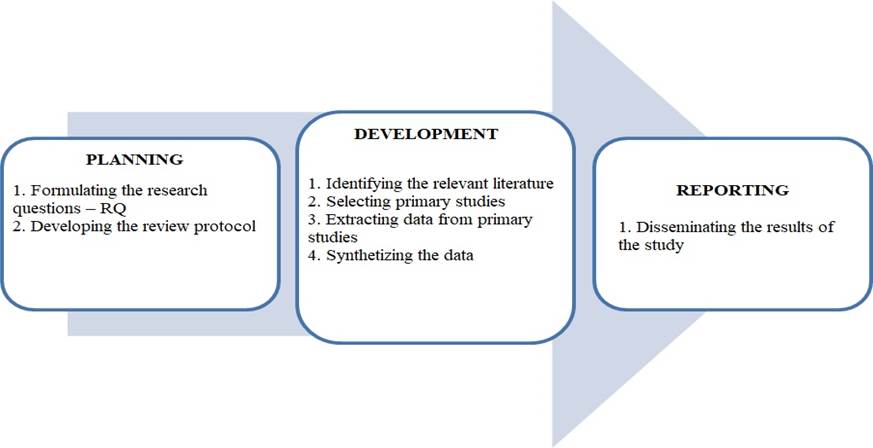

In our literature review approach, we started from the idea defined by Kitchenham and Charters (2007), that a SLR is a method that identifies, evaluates and interprets all findings from a research item. To answer the questions of our research, we carried out three stages: planning, development and reporting, for each stage the details being highlighted in figure 1.

Figure 1. Details of the stages of the systematic literature review

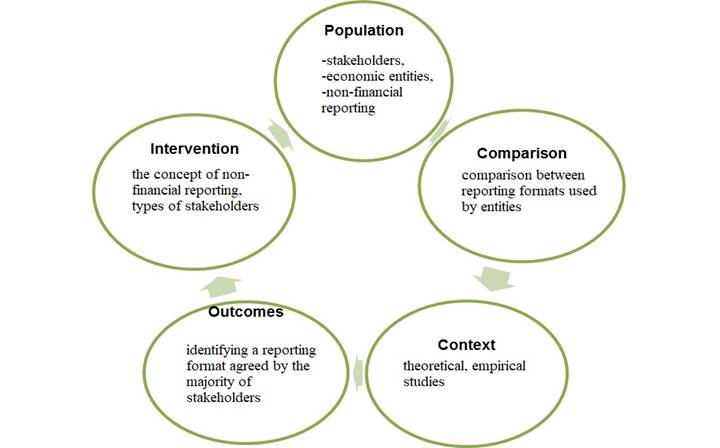

In order to formulate research questions RQ, which will guide us in the process of searching and extracting the relevant literature, we have counted on five elements, known as PICOC, suggested by Petticrew and Roberts (2006):

1. Population - P: the target group of keywords relevant to our research;

2. Intervention - I: defining the methodological and procedural aspects of which the researcher is interested;

3. Comparison - C: comparing the intervention to the investigation;

4. Outcomes - O: the effects and results of the intervention;

5. Context - C: establishing the investigation environment.

In figure 2 we present, according to the PICOC model, a summary of the structure of the research questions, which will guide us in our approach.

Figure 2. Summary of PICOC questions

The search process strategy aims to identify relevant studies for the research problems pursued. The RQ research questions, which will guide us in identifying a synoptic area, relevant to our work, will be:

• RQ1 What are the factors that influence the non-financial reporting format in the specialized literature?

• RQ2 What is the impact of stakeholders on the format of non-financial reporting of economic entities?

• RQ3 How is the performance of the economic entity influenced by the non-financial reporting?

We accessed the electronic resource E-nformation (https://www.e-nformation.ro) that allowed us access to the bibliographic and bibliometric databases of two internationally recognized companies: Clarivate Analytics, which manages the Web of Science Core Collection database and Elsevier, who manages Scopus. We chose the two databases because they complement each other, no resources are duplicated, and the databases start from 1975 for the Web of Science Core Collection (WOS) and 1960 for Scopus.In the search construction for the two databases, we combined the requirements of the Boley logic with the fuzzy ones, for the Web of Science Core Collection resulting the search string (stakeholder *) AND (performance*) AND (nonfinancial reporting OR integrated*), and for Scopus the search string “stakeholder” AND “performance” AND “non-financial reporting” OR “integrated”. Starting from Fink (2005) and Ridley (2008), which delimit different types of database sources and offer a Boolean search strategy, we avoided combining more than four search words because it is known that a larger number means a high risk of omitting relevant articles. We did not use the Boolean operator "NOT" in the systematic search strategy because it also increased the risk of omitting relevant articles.

In the WOS database, the use of the truncation operator * at the end of each keyword allowed us to find all the variants derived from those words. The use, in the Scopus database, of quotation marks around words provided us with greater accuracy in finding the relevant articles for our study.1426 scientific articles in the Web of Science Core Collection and 1590 in Scopus have resulted. For both databases we limited ourselves to the period 1975-2019. The areas included in our research, from both databases, were: management, business, accounting, finance, economics, econometrics.

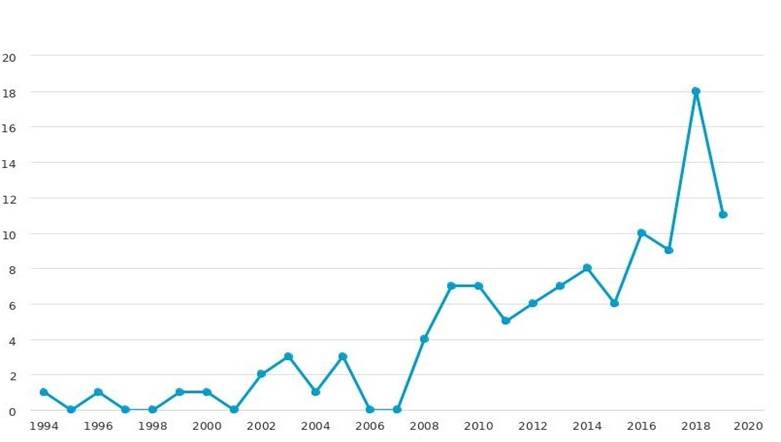

As a result, following the inclusion of the “research field” criterion, we obtained 213 scientific articles in the Web of Science Core Collection and 138 in Scopus. We have included two types of publications, journal papers and conference proceedings, limiting ourselves only to those written in English. Following the application of this new selection criterion, 109 scientific articles in the Web of Science Core Collection and 111 in Scopus resulted, which we consider as primary studies. We downloaded the "pdf" version of these articles and stored them in the Mendeley software (https://menedeley.com), which contains comprehensive bibliographic references and which facilitates the management of the selected literature. Following the interest of the researchers, in Scopus, for the concepts "stakeholders", "performance" and "non-financial/integrated reporting" we observe, from figure 3, an interest relatively low between 1997-2003. This low interest can be associated with the fact that, during this period, corporate reporting has traditionally been considered as a crucial form of communication of economic entities with participants in the capital market, investors and other capital providers, being limited only to the procedure for reporting corporate assets and yields in an exclusively financial format. The emergence of the codes that regulate the principles of corporate governance (King I, II, III) that regulated the concept of "integrated sustainability reporting" and which strengthened the founding of the Global Reporting Initiative (GRI), as well as the establishment, in 2010, of the International Integrated Reporting Council (IIRC), which launched a framework for integrated reporting, appreciated by the stakeholders, determined an increase in the number of studies between 2011-2012. The emergence, in 2014, of Directive 95/2014/EU amending Directive 2013/34/EU within the meaning of introducing the obligation to report non-financial performance for certain types of organizations and to report the diversity policy applied to the governing and supervisory bodies of the company, as well as the emergence of the King IV report (2016), which adopts the "apply and explain" principle, has reinforced a considerable number of studies in the period 2015-2018.

Figure 3. Distribution, by years, of Scopus studies

As our work aims to report non-financial information at the level of economic entities, we have introduced as criteria for excluding, from the two databases, studies from the following fields:

• education;

• health

• public administration;

• banks, financial and insurance institutions;

• non-governmental/non-profit organizations.

We excluded, reading the summary, the studies that did not answer any of the three research questions (RQ). 61 primary studies in WOS and 35 primary studies in Scopus, included in Annex 1 have resulted. The selected primary studies are extracted to collect data that contribute to addressing research questions. In order to identify the factors that influence the non-financial reporting format in the specialized literature (RQ1), we read the 96 selected studies. The results obtained for CSR reporting, respectively sustainability reporting, are shown in Table 1.

Table 1. Factors influencing CSR reporting format/sustainability

| Identified factors | Study identifier Annex 1- ID |

| Stakeholders | 1, 24, 30, 38, 47, 50, 57, 74, 80, 82, 83, 91, 94 |

| Company performance | 35, 42, 48, 55, 59, 60, 86, 88, 89 |

| Social performance | 25 |

| Financial performance | 16, 17 |

| Structure of the board of directors/gender diversity | 15, 63, 69, 71, 78, 89 |

| Quality of management | 2, 41, 93 |

| Social management | 75 |

| Company control by reporting | 56, 61 |

| Ethical behaviour | 21 , 22, 35, 45, 47, 50 |

| Disclosure of environmental information | 29, 38, 45 |

| Macroeconomic environment/periods of economic crisis | 10, 53, 66 |

| The brand/trademark of the company | 4, 36 |

| Incorrect practices/avoidance of stakeholder control | 27, 68, 79 |

| Company size | 58 |

| Shareholders | 37 |

| Efficiency of work organization | 45 |

| Local rules | 18 |

Source: Own processing

The concept of CSR has received wider recognition and acceptance in corporate reporting practices and has become an essential requirement of the various regulatory bodies in each sector of the economy, especially in emerging economies. In general, the reports entitled "CSR reports" and "sustainability reports" are the most complete and extensive types of non-financial reports, integrating the "triple bottom line" approach with the management model and stakeholders (Perini, 2006). At the same time, there has been an increase in organizations' awareness of how the communication of social, environmental and governance issues helps them improve their corporate reputation and image (Camilleri, 2015).

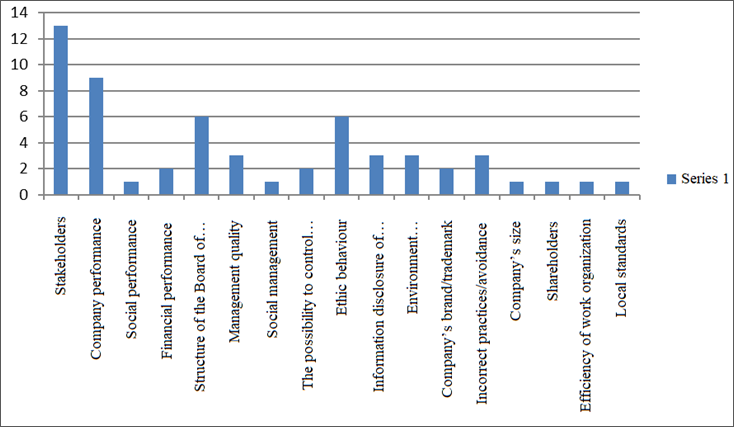

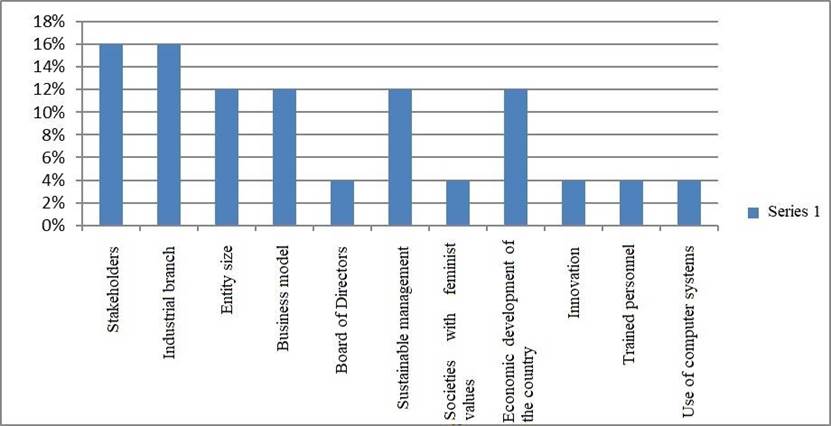

In the age of globalization, stakeholders have high expectations from organizational and business reporting practices, as each organization, whether operating in a developed or developing economy, strives to meet the demands of key stakeholders. We note that the way in which the reports on the economic, environmental and social impact, caused by the activity of the economic entity, are prepared is influenced by the stakeholders, 13 studies capturing this phenomenon. It is in the interests of economic entities to implement sustainability and social corporate responsibility and to create fruitful relationships with key stakeholders, including regulatory ones, in order to address social economic, social, environmental and governance deficiencies. The integration of the concept of stakeholders with that of performance, noted by Simmons (2003), is highlighted, in 9 studies, as an important factor in influencing the CSR reporting format. The influence of the structure of the board of directors, in the company's CSR reporting, is confirmed by 6 studies, influence seconded by the corporate ethical behaviour - 6 studies. The graph in figure 4 also captures the other influencing factors of CSR reporting, highlighted in a smaller number of studies.

Figure 4. Number of studies according to the CSR reporting influence factors

Integrated reporting is a way of addressing sustainability/durability issues with the internal decision making and basic business planning needs. Effective stakeholder involvement allows an economic entity to better identify and understand the legitimate needs and expectations of powerful representatives and how to best address them in the integrated reporting process (Alrazi et al., 2015). Because an integrated report is a concise communication about how the strategy, governance, performance and prospects of an economic entity, in the context of the external environment, lead to the creation of short, medium and long-term value, we have tried to identify the factors that favour integrated reporting, which we highlighted in table 2.

Table 2. Factors influencing the integrated reporting format

| Identified factors | Study identifier annex 1-ID |

| Stakeholders | 62, 65, 68, 81 |

| Industrial branch | 40 ,43, 64, 65 |

| The size of the economic entity | 40, 64, 65 |

| Business model | 62, 77, 85 |

| Structure of the board of directors/gender diversity | 40 |

| Sustainable management | 44, 77, 81 |

| Societies with collectivist and feminist values | 87 |

| The level of economic development of the country | 54, 64, 65 |

| Innovation | 49 |

| Existence/non-existence of trained personnel | 73 |

| Using Business Intelligence Computer Systems | 46 |

Source: Own processing

We note that the stakeholders influence the integrated reporting, which is quite natural, if we consider that the purpose of the integrated reporting framework is to improve the quality of the information available to the stakeholders which are financial capital providers through the integrated reporting, which must demonstrate the quality of the economic entity's relations with all stakeholders.

The specificity of the industrial branch in which the economic entity operates its business is another main factor influencing integrated reporting because companies operating in sensitive industries with higher environmental performance are more likely to present a holistic or integrated level of integration (Camilleri, 2015; Albertini, 2018; Brusco et al., 2019).

The size of the economic entity is another factor influencing integrated reporting, because the larger entities, which are more profitable, have a larger cash flow and produce integrated quality reports (Buitendag, 2017). The business model, sustainable management and economic development of the country are factors that significantly influence the integrated reporting (Kiliç et al. 2018; Hoque, 2017; Boonlua, 2016; Demartini, 2015; Jhunjhunwala, 2014). In figure 5, we can trace the percentage distribution of the studies, grouped by the influencing factors of the integrated reporting. It is noted that the most significant influencing factors of integrated reporting are: stakeholders (18%), the specificity of the industrial branch in which the economic entity activates (18%), the business model (12%), the size of the economic entity (12%), economic development of the country (12%) and sustainable management (12%).

Figure 5 Distribution of studies by influencing factors on integrated reporting

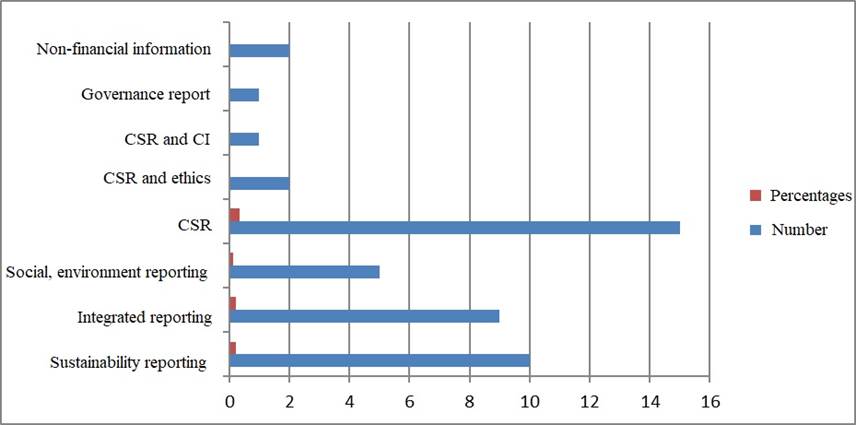

Stakeholder theory argues that, well above the individual interests of shareholders, the company should prioritize the global interests of the stakeholders (Greenwood and Cieri, 2005). When deciding the content of its report, an organization must take into account the expectations and reasonable interests of the stakeholders. A stakeholder engagement process can serve as a tool to understand the stakeholders' expectations and reasonable interests, as well as their information needs. Consequently, accountability to stakeholders needs to build an adequate accounting and reporting system, incorporating stakeholders' voices into its records, translating them into reliable, systematic, and responsible measures (Hall et al., 2015). Starting from Freeman's (1984) idea that the dynamic nature of stakeholder influence on corporate decision requires companies to continually adapt their reporting operations and strategies to respond to changing stakeholder’s demands and expectations, and seeking an answer to the RQ2 research question (What is the impact of stakeholders on the format of non-financial reporting of economic entities?) we read the 96 primary studies. We identified 45 studies that answered the RQ2 research question, obtaining the reporting formats that we grouped in table 3.

Table 3. Non-financial reporting format

| Non-financial reporting format | Study identifier annex 1-ID |

| Sustainability reporting | 1,4,8,13,56,57,76,79,83 |

| Integrated reporting | 6,40,43,44,54,65,73,85,87 |

| Social, environment reporting, | 10,19,29,38,51 |

| Non-financial information | 16,60 |

| RSC and ethic | 21,22 |

| RSC | 23,28,31,33,37,42,45,47,48,50,53,58,63,89,91 |

| RSC and Intellectual Capital (IC) Statement | 30 |

| Governance Report | 80 |

Source: Own processing

From Figure 6 we observe that, in 15 studies, CSR reporting is considered to be the format that corresponds to the needs of stakeholders, confirming that CSR has been used by companies to manage their relationship with internal and external stakeholders, especially with those parties. considered to be strong or having a significant impact on the company (Ullmann, 1985, Huang and Kung, 2010). Because corporate social responsibility (CSR) “is a concept by which companies integrate social and environmental concerns into their business operations and in their interactions with stakeholders”, 5 studies associate social and environmental reporting as the format that meets stakeholders' expectations. Caroll (1979) said that "the social responsibility of the business encompasses the economic, legal, ethical and discretionary expectations that the company has on the organizations at a given moment", an idea that was captured in two studies that associate CSR with ethics. Creating an appropriate balance between the three aspects of corporate sustainability (economic, environmental, social) is vital in order to protect the interest of both shareholders and of other stakeholders, 9 studies confirming sustainability reporting as an optimal reporting format for stakeholders. Integrated reporting has emerged in response to growing stakeholder demands for a broader range of useful decision-making information, compared to conventional corporate financial reports (du Toit, 2017), 9 studies from our research considering that integrated reporting provides essential information for a meaningful evaluation of the economic entity's long-term business model and strategy and responds to the information needs of investors and other stakeholders.

Figure 6. Distribution of non-financial reporting type

The objective of traditional financial reporting is to measure historical performance and that is why, in a world where the market value of the company is decoupled from the value of its basic assets, non-financial information provides an instrument for measuring the value of the company that results from intangible assets and future cash flows, information which is missing from traditional financial reports (Lev, 2001). The call for the disclosure of non-financial information has increased in response to the awareness that financial statements omit important information about the company, and integrated reporting is a means of providing a more coherent, balanced and complete picture of company performance (Adams et al., 2011). Integrated performance management will always need a common, fungible measure for analysis, whether it's monetary values, non-financial numbers or another common denominator. Noting the lack of integration between financial and non-financial performance and a fragmentation in the reporting practices of economic entities, we considered it appropriate to find the answer to the research question RQ3- How is the performance of the economic entity influenced by non-financial reporting? Of the 96 primary studies, 32 studies approached in a diversified way, presented in table 4, the concept of performance reflected in the types of non-financial reporting.

Table 4. Types of performance and non-financial reporting

| Study identifier ID | Performance type | Reporting type |

| 7 | Non-financial performance | CSR |

| 8 | Sustainability performance | IR |

| 7 | Environmental performance | CSR |

| 10 | Future performance | CSR |

| 11 | Organizational performance | IR |

| 15 | organizational performance | CSR |

| 16 | Non-financial performance | External report |

| 17 | CSR Performance | CSR |

| 19 | Social and environmental performance | CSR |

| 25 | Financial performance | CSR Ethics |

| 26 | Organizational performance | CSR |

| 27 | CSR Performance | CSR |

| 28 | Organizational performance | CSR |

| 30 | Organizational performance | CSR |

| 33 | CSR Performance | CSR |

| 35 | Social performance | IR |

| 46 | Organizational performance | IR |

| 47 | CSR Performance | CSR |

| 51 | Environmental performance | CSR |

| 52 | Sustainability performance | Sustainability reporting |

| 59 | Business performance | Environment CSR |

| 60 | Financial performance | CSR |

| 63 | Organizational performance | CSR |

| 65 | Financial/non-financial performance | IR |

| 68 | CSR Performance | CSR |

| 73 | Sustainability performance | IR |

| 78 | Organizational performance | CSR |

| 80 | Social and environmental performance | Sustainability reporting |

| 85 | Non-financial performance | IR |

| 88 | Financial performance | IR |

| 89 | Business performance | CSR |

| 95 | Financial performance | Non-financial reporting |

Source: Own processing

Most studies have positively associated the concept of organizational performance with CSR and integrated reporting (8 studies). Table 5 reflects the positive associations between various performance concepts and types of non-financial reporting, Soliman (2013) noting that empirical evidence confirms a positive association between final performance and non-financial reporting. The decrease in the relevance of financial information in explaining the value of a company (Lev and Zarowin, 1999; Francis and Schipper, 1999), acknowledges that the information in the financial statements is insufficient to meet the information needs of stakeholders in order to evaluate the performance of companies. Stakeholders exert pressure on companies to report non-financial information about their strategy, investments and dissemination of customer satisfaction levels, to judge long-term performance and predict future earnings.

Table 5. Positive associations between the concept of performance and non-financial reporting type

| Performance types | No. of studies | Reporting type |

| Non-financial performance | 3 | 1 IR, 1External report, 1 CSR |

| Sustainability performance | 3 | 2 IR, 1 Sustainability report |

| Organizational performance | 8 | 6 CSR, 2 IR |

| CSR Performance | 3 | 3 CSR |

| Financial performance | 4 | 1 IR, 1 CSR ethics, 1 CSR, 1 Non-financial reporting |

| Social and environmental performance | 2 | 1 CSR, 1 Sustainability report |

| Business performance | 2 | 1 CSR, 1 CSR environment |

| Financial performance | 4 | 1Non-financial reporting, 1 CSR etic, 1 CSR, 1 IR |

| Social performance | 1 | 1 IR |

| Financial/non-financial performance | 1 | 1 IR |

| Environmental performance | 1 | 1 CSR |

Source: Own processing

Moreover, greater transparency leads to better confidentiality, image and reputation of stakeholders in the organization, such as investors, employees and customers, which results in better performance and value (Cormier et al., 2013; Athanasakou and Hussainey, 2014). Clarkson et al. (1994, 1999) find that both frequency and changes in prospective communications make annual corporate reports more informative about future performance.

3. 3. Conclusions

This literature review aimed to identify the factors that influence the type of non-financial reporting, the impact of stakeholders on the non-financial reporting format, and how performance is influenced by the type of non-financial reporting. Based on the projected criteria of inclusion and exclusion, 96 studies published between 1999-2019 were left, which we considered as primary studies and on which we based our literature review, conceived as a systematic review of SLR literature. We chose this type of literature review because SLR is defined as a “process of identifying, evaluating and interpreting all available research evidence in order to answer specific research questions” (Wahono, 2015). One challenge in achieving this SLR was the fact that there is no guide for carrying out this type of literary review in the field of accounting, and that there is sufficient fragmentation in the research literature in defining non-financial information and non-financial reporting. Haller et al. (2017) confirms this lack of convergence in the definition of non-financial information and notes that, to date, there is no common sense and no generally accepted definition of non-financial information. The same heterogeneity in defining the basic concepts related to non-financial reporting is also noticed by Stolowy and Paugam (2018).

Despite the general awareness of the increasing importance of non-financial information in order to judge the performance of economic entities, the existing literature is still "struggling" to constantly define non-financial information. One explanation for this inconsistency is that non-financial information represents or acts on entirely different issues, such as information on strategy, social responsibility, corporate governance, internal control or risk management (Said et al., 2003).

The same heterogeneity is also reflected in the name of non-financial reporting identified in the 96 studies: sustainability reporting, integrated reporting, social reporting, environment, non-financial information reporting, CSR and ethics, CSR, CSR and the Statement on intellectual capital, governance report. Stakeholders areexerting pressure on economic entities to report non-financial information, becoming in our analysis the significant influence factor of CSR and of integrated reporting. CSR reporting is considered by most researchers to be the format that meets the needs of stakeholders, confirming that this type of reporting has been used by companies to manage their relationship with internal and external stakeholders. Also, most studies have positively associated the concept of organizational performance with CSR. In the analysis of the primary studies we used quantitative data, but also qualitative data, starting from the idea expressed by Campbell (1984) that the incorporation of qualitative data into syntheses can offer "situation-specific wisdom".

ANNEX 1. Primary studies WOS and Scopus

| ID | Title | Authors | Year | Journal |

| 1 | Toward Sustainability and Integrated Reporting | Shoaf, Victoria et.al. | 2018 | REVIEW OF BUSINESS |

| 2 | Total quality and socially responsible management (TQSR-M) An integrated conceptual framework | Khurshid, Muhammad Adnan | 2018 | BENCHMARKING-AN INTERNATIONAL JOURNAL |

| 3 | An Innovative Approach to Stakeholder Theory: application in spanish transnational corporation | Luis Retolaza, Jose | 2015 | RBGN-REVISTA BRASILEIRA DE GESTAO DE NEGOCIOS |

| 4 | Sustainability and branding: An integrated perspective | Kumar, V | 2014 | INDUSTRIAL MARKETING MANAGEMENT |

| 5 | Integrated Performance Management System in a Globalized Organization | Armenia, Androniceanu | 2017 | FINANCE AND PERFORMANCE OF FIRMS IN SCIENCE, EDUCATION, AND PRACTICE |

| 6 | Marketing Communications of Value Creation in Sustainable Organizations. The practice of Itegrated reports | Dumitru, Madalina | 2015 | AMFITEATRU ECONOMIC |

| 7 | The Global Reporting Initiative: do application levels matter? | Simmons Jr | 2018 | SOCIAL RESPONSIBILITY JOURNAL |

| 8 | The materiality matrix - an emerging tool for sustainability performance disclosure | Lungu, Camelia Iuliana | 2017 | PROCEEDINGS OF THE 12TH INTERNATIONAL CONFERENCE ACCOUNTING AND MANAGEMENT INFORMATION SYSTEMS |

| 9 | Could lean and green be the driver to integrate business improvement throughout the organisation? | Chaplin, Lara | 2018 | INTERNATIONAL JOURNAL OF PRODUCTIVITY AND PERFORMANCE MANAGEMENT |

| 10 | Is CSR reporting always favorable? | Al-Dah, Bilal | 2018 | MANAGEMENT DECISION |

| 11 | Introduction to the PENTACLE performance measurement system | Reis, P R | 1997 | B&ESI: BUSINESS & ECONOMICS FOR THE 21ST CENTURY, VOL I: ANTHOLOGY |

| 12 | Managing Contradiction: Stockholder and Stakeholder Views of the Firm as Paradoxical Opportunity | Clark, Cynthia E | 2016 | BUSINESS AND SOCIETY REVIEW |

| 13 | Intellectual Capital and the Triple Bottom Line: Overview, Concepts and Requirements for an integrated Sustainability Management System | Mertins, Kai | 2012 | PROCEEDINGS OF THE 4TH EUROPEAN CONFERENCE ON INTELLECTUAL CAPITAL |

| 14 | Working on a dream: sustainable organisational change in SMEs using the example of the Austrian wine industry | Hatak, Isabella | 2015 | REVIEW OF MANAGERIAL SCIENCE |

| 15 | Interlocking Directorships and the Corporate-Community Connection: Evidence | Wells, Philippa | 2015 | Proceedings of the 11th European Conference on Management Leadership and Governance |

| 16 | Characteristics of performance measures for external reporting | Bescos, Pierre-Laurent | 2007 | TOTAL QUALITY MANAGEMENT & BUSINESS EXCELLENCE |

| 17 | The effects of stakeholders on CSR disclosure: evidence from Japan | Saka, Chika | 2013 | PROCEEDINGS OF THE 8TH INTERNATIONAL CONFERENCE ACCOUNTING AND MANAGEMENT INFORMATION SYSTEMS |

| 18 | Institutional legitimacy and norms-based CSR marketing practices Insights from MNCs operating in a developing economy | Khan, Zaheer | 2015 | INTERNATIONAL MARKETING REVIEW |

| 19 | Nature of Non-Financial Information Disclosed By Polish Organisations | Maj, Jolanta | 2018 | INNOVATION MANAGEMENT AND EDUCATION EXCELLENCE THROUGH VISION 2020 |

| 20 | From Silent to Salient Stakeholders: A Study of a Coffee Cooperative and the Dynamic of Social Relationships | Davila, Anabella | 2017 | BUSINESS & SOCIETY |

| 21 | Ethical behavior integrated into CSR: How to create and mainatain the corporate reputation | Gazzola, Patrizia | 2017 | STRATEGICA: SHIFT! MAJOR CHALLENGES OF TODAY'S ECONOMY2017 |

| 22 | Symbolic or substantive document? The influence of ethics codes on financial executives' decisions | Stevens, J M | 2005 | STRATEGIC MANAGEMENT JOURNAL |

| 23 | The Impact of Media Reputation on Stock Market and Financial Performance of Corporate Social Responsibility Winner | Van Riel, A C R | 2018 | NTU MANAGEMENT REVIEW |

| 24 | Foreign board membership and firm value in Korea | Choi, Hyang Mi | 2012 | MANAGEMENT DECISION |

| 25 | Commitment in corporate social responsibility and financial performance: a study in the Tunisian context | Chtourou, Haifa | 2017 | SOCIAL RESPONSIBILITY JOURNAL |

| 26 | Doing well by doing good? Implementing new effective integrated CSR strategy | Kittilaksanawong, Wiboon | 2011 | AFRICAN JOURNAL OF BUSINESS MANAGEMENT |

| 27 | Corporate social responsibility and earnings management of South African companies | Jordaan, Lauren A | 2018 | SOUTH AFRICAN JOURNAL OF ECONOMIC AND MANAGEMENT SCIENCES2018 |

| 28 | Corporate Social Responsibility - Chance for Competitiveness in Croatia | Zakarija, Marija | 2005 | ENTREPRENEURSHIP AND MACROECONOMIC MANAGEMENT |

| 29 | The Influence of Corporate Governance on Environmental Disclosure of Listed Non-Financial Firms in Nigeria | Odoemelam, Ndubuisi | 2018 | INDONESIAN JOURNAL OF SUSTAINABILITY ACCOUNTING AND MANAGEMENT |

| 30 | Corporate Social Responsibility plus Intellectual Capital = Integrated Reporting? | Branwijck, Deborah | 2012 | PROCEEDINGS OF THE 4TH EUROPEAN CONFERENCE ON INTELLECTUAL CAPITAL |

| 31 | The practitioner's perspective on non-financial reporting | Perrini, F | 2006 | CALIFORNIA MANAGEMENT REVIEW |

| 32 | Creating shared value in Moroccan companies: a case study of OCP SA | Elamrani, Jamal | 2016 | TRANSNATIONAL CORPORATIONS REVIEW |

| 33 | Fuzzy Comprehensive Evaluation on Corporate Social Responsibility Performance from the Perspective of Stakeholders | Zhuquan, Wang | 2011 | PROCEEDINGS OF THE SIXTH INTERNATIONAL SYMPOSIUM ON CORPORATE GOVERNANCE |

| 34 | The Corporate Socially Responsible Investing Criteria in Private Equity: Relevance and Business Impact | Vega Vidal, Jose Antonio | 2015 | STRATEGICA: LOCAL VERSUS GLOBAL |

| 35 | Integrated and decoupled corporate social performance: Management commitments, external pressures, and corporate ethics practices | Weaver, G R | 1999 | ACADEMY OF MANAGEMENT JOURNAL |

| 36 | Corporate social responsibility brand leadership: a multiple case study | Lindgreen, Adam | 2012 | EUROPEAN JOURNAL OF MARKETING |

| 37 | Does media pressure moderate CSR disclosures by external directors? | Garcia-Sanchez, Isabel-Maria | 2014 | MANAGEMENT DECISION |

| 38 | Stakeholders' impact on the environmental responsibility: Model design and testing | Smaliukien, Rasa | 2007 | JOURNAL OF BUSINESS ECONOMICS AND MANAGEMENT |

| 39 | Conceptual framework for corporate accountability in the context of sustainability - a literature review | Mohammed, Munif | 2013 | 5TH ANNUAL EUROMED CONFERENCE OF THE EUROMED ACADEMY OF BUSINESS: BUILDING NEW BUSINESS MODELS FOR SUCCESS THROUGH COMPETITIVENESS AND RESPONSIBILITY |

| 40 | Firm characteristics and excellence in integrated reporting | Buitendag, Natasha | 2017 | SOUTH AFRICAN JOURNAL OF ECONOMIC AND MANAGEMENT SCIENCES |

| 41 | The integration of CSR into strategic management: a dynamic approach based on social management philosophy | Vitolla, Filippo | 2017 | CORPORATE GOVERNANCE-THE INTERNATIONAL JOURNAL OF BUSINESS IN SOCIETY |

| 42 | Stakeholders in automotive sectors in theCzech Republic | Hana, Scholleova | 2017 | FINANCE AND PERFORMANCE OF FIRMS IN SCIENCE, EDUCATION, AND PRACTICE |

| 43 | Integrated reporting: an exploratory study of French companies | Elisabeth Albertini | 2018 | JOURNAL OF MANAGEMENT AND GOVERNANCE |

| 44 | Assessing current company reports according to the IIRC integrated reporting framework | Merve Kiliç, Cemil Kuzey | 2018 | Meditari Accountancy Research |

| 45 | Corporate Social Responsibility in Kazakhstan: Content Analysis of Annual Reports of the Listed Oil and Gas Companies | Markhayeva, Bayanslu | 2016 | PROCEEDINGS OF THE 4TH INTERNATIONAL CONFERENCE ON MANAGEMENT, LEADERSHIP AND GOVERNANCE |

| 46 | Business Intelligence Applied Towards Facilitating Integrated and Sustainability | James, Gregory | 2016 | PROCEEDINGS OF THE 17TH EUROPEAN CONFERENCE ON KNOWLEDGE MANAGEMENT |

| 47 | Ethical considerations of corporate social responsibility - A South African perspective | Ackers, B | 2015 | SOUTH AFRICAN JOURNAL OF BUSINESS MANAGEMENT |

| 48 | Corporate Leadership in the 21st Century and its Influence in Sustainability Reporting | Zborkova, Jitka | 2012 | PROCEEDINGS OF THE 8TH EUROPEAN CONFERENCE ON MANAGEMENT LEADERSHIP AND GOVERNANCE |

| 49 | The performance frontier Innovating for a Sustainable Strategy | Eccles, Robert G | 2013 | HARVARD BUSINESS REVIEW |

| 50 | CSR in an emerging country: a content analysis of CSR reports of listed companies | Gao, Yongqiang | 2011 | BALTIC JOURNAL OF MANAGEMENT |

| 51 | Does environmental performance affect companies' environmental disclosure? | Fontana, Stefano | 2015 | MEASURING BUSINESS EXCELLENCE |

| 52 | Performance Audit Considering the Sustainability: Approach of the Czech Enterprises | Horova, Michaela | 2012 | PROCEEDINGS OF THE 8TH EUROPEAN CONFERENCE ON MANAGEMENT LEADERSHIP AND GOVERNANCE |

| 53 | Financial crisis impact on sustainability reporting | Antonia Garcia-Benau, Ma | 2013 | MANAGEMENT DECISION |

| 54 | Integrating reporting - A new dimension to traditional reporting | Turturea, Mihaela | 2014 | PROCEEDINGS OF THE 9TH INTERNATIONAL CONFERENCE ACCOUNTING AND MANAGEMENT INFORMATION SYSTEMS |

| 55 | Corporate sustainability reporting practices in India: myth or reality? | Laskar, Najul | 2016 | SOCIAL RESPONSIBILITY JOURNAL |

| 56 | The effect of equity and bond issues on sustainability disclosure. Family vs non-family Italian firms | Gavana, Giovanna | 2017 | SOCIAL RESPONSIBILITY JOURNAL |

| 57 | Valuing Stakeholder Engagement and Sustainability Reporting | Camilleri, Mark Anthony | 2015 | CORPORATE REPUTATION REVIEW |

| 58 | Is corporate governance relevant to the quality of corporate social responsibility disclosure in large European companies? | Adel, Christine | 2019 | INTERNATIONAL JOURNAL OF ACCOUNTING & INFORMATION MANAGEMENT |

| 59 | Does CSR practice pay off in East Asian firms? A meta-analytic investigation | Hou, Mingjun | 2016 | ASIA PACIFIC JOURNAL OF MANAGEMENT |

| 60 | The Relationship between Non-financial Reporting, Environmental Strategies and Financial Performance. Empirical Evidence from Milano Stock Exchange | Pizzi, Simone | 2018 | ADMINISTRATIVE SCIENCE |

| 61 | Non-financial reports, anti-corruption performance and corporate reputation | Maider Aldaz | 2015 | REVISTA BRASILEIRA DE GESTAO DE NEGOCIOS |

| 62 | Why Company Should Adopt Integrated Reporting? | Mohammad Enamul Hoque | 2017 | International Journal of Economics and Financial Issues, |

| 63 | Is corporate governance relevant to the quality of corporate social responsibility disclosure in large European companies? | Adel, C., Hussain, M.M., Mohamed, E.K.A., Basuony, M.A.K. | 2019 | International Journal of Accounting and Information Management |

| 64 | The determinants of companies’ levels of integration: Does one size fit all? | Busco, C., Malafronte, I., Pereira, J., Starita, M.G. | 2019 | British Accounting Review |

| 65 | Theoretical insights on integrated reporting: The inclusion of non-financial capitals in corporate disclosures | Camilleri, M.A. | 2018 | Corporate Communications |

| 66 | Sustainability in the Pakistani hotel industry: an empirical study | Sajjad, A., Jillani, A., Raziq, M.M. | 2018 | Corporate Governance (Bingley) |

| 67 | Strategic performance management system in uncertain business environment: An empirical study of the Indian oil industry | Akhtar, M., Sushil, S. | 2018 | Business Process Management Journal |

| 68 | Corporate social responsibility and earnings management of South African companies | Jordaan, L.A., de Klerk, M., de Villiers, C.J. | 2018 | South African Journal of Economic and Management Sciences |

| 69 | Ownership concentration, board characteristics and firm performance among Shariah-compliant companies | Shahrier, N.A., Ho, J.S.Y., Gaur, S.S. | 2018 | Journal of Management and Governance |

| 70 | An integrated network model for performance management: A focus on healthcare organisations | Marcarelli, G. | 2018 | International Journal of Managerial and Financial Accounting |

| 71 | Board gender diversity and ESG disclosure: evidence from the USA | Manita, R., Bruna, M.G., Dang, R., Houanti, L. | 2018 | Journal of Applied Accounting Research |

| 72 | Performance-oriented office environments – framework for effective workspace design and the accompanying change processes | Kämpf-Dern, A., Konkol, J. | 2017 | Journal of Corporate Real Estate |

| 73 | Exploring the challenges of preparing an integrated report | Mcnally, M.-A., Cerbone, D., Maroun, W. | 2017 | Meditari Accountancy Research |

| 74 | Exploring communication in project-based interventions | Parker, D.W., Kunde, R., Zeppetella, L | 2017 | International Journal of Productivity and Performance Management |

| 75 | The integration of CSR into strategic management: a dynamic approach based on social management philosophy | Vitolla, F., Rubino, M., Garzoni, A. | 2017 | Corporate Governance (Bingley) |

| 76 | Business sustainability research: A theoretical and integrated perspective | Rezaee, Z. | 2016 | Journal of Accounting Literature |

| 77 | Engagement in integrated reporting: Evidence from the international integrating reporting council adoption framework | Boonlua, S., Phankasem, S. | 2016 | Journal of Business and Retail Management Research |

| 78 | Corporate governance, firm risk, and corporate social responsibility: Evidence from korean firms | Lee, S., Kim, Y.K., Kim, K. | 2016 | Journal of Applied Business Research |

| 79 | Non-financial reports, anti-corruption performance and corporate reputation | Aldaz, M., Alvarez, I., Calvo, J.A. | 2015 | Revista Brasileira de Gestao de Negocios |

| 80 | Monitoring and evaluation of corporate social responsibility programmes in South Africa | Rampersad, R. | 2015 | Risk Governance and Control: Financial Markets and Institutions |

| 81 | Sustainability and intangibles: Evidence of integrated thinking | Demartini, P., Paoloni, M., Paoloni, P. | 2015 | Journal of International Business and Economics |

| 82 | Stakeholder expectations on csr management and current regulatory developments in europe and Germany | Müller, S., Stawinoga, M. | 2015 | Corporate Ownership and Control |

| 83 | Valuing Stakeholder Engagement and Sustainability Reporting | Camilleri, M.A. | 2015 | Corporate Reputation Review |

| 84 | What qualitative research can tell us about performance management systems | Cohanier, B. | 2014 | Qualitative Research in Accounting and Management |

| 85 | Beyond financial reporting-international integrated reporting framework | Jhunjhunwala, S. | 2014 | Indian Journal of Corporate Governance |

| 86 | Strategic implications of water usage: An analysis in Brazilian Mining Industries | Bichueti, R.S., Gomes, C.M., Kruglianskas, I., Kneipp, J.M., da Rosa, L.A.B. | 2014 | Journal of Technology Management and Innovation |

| 87 | The cultural system and integrated reporting | García-Sánchez, I.-M., Rodríguez-Ariza, L., Frías-Aceituno, J.-V. | 2013 | International Business Review |

| 88 | An integrated corporate governance framework and financial performance in South African-listed corporations | Ntim, C.G. | 2013 | South African Journal of Economics |

| 89 | Convergence of corporate governance and corporate social responsibility | Smith Bogart, K.A. | 2013 | International Journal of Human Resources Development and Management |

| 90 | The relationship between the adoption of triple bottom line and enhanced corporate reputation and legitimacy | Sridhar, K. | 2012 | Corporate Reputation Review |

| 91 | Motivate your bright people for competitive advantage: How Indra introduced integrated CSR to transform its corporate strategy | Strategic Direction | 2011 | Strategic Direction |

| 92 | Accounting information for managerial decision-making in shareholder management versus stakeholder management | Wall, F., Greiling, D. | 2011 | Review of Managerial Science |

| 93 | Corporate social responsibility and corporate performance: The case of Italian SMEs | Longo, M., Mura, M., Bonoli, A. | 2005 | Corporate Governance |

| 94 | Communicating knowledge about police performance | Collier, P.M., Edwards, J.S., Shaw, D. | 2004 | International Journal of Productivity and Performance Management |

| 95 | Valid and reliable measurements for sustainable non-financial reporting | Kristensen, K., Westlund, A.H. | 2003 | Total Quality Management and Business Excellence |

| 96 | Stakeholder flexibility in E-business environment: A case of an automobile company | Dwivedi, R., Momaya, K. | 2003 | Global Journal of Flexible Systems Management |

References

- Allianz and Euler Hermes Economic Research, 2019. Global Trade Report [online] Available at: https://www.eulerhermes.com/content/dam/onemarketing/euh/eulerhermes_com/erd/publications/pdf/Trade-report-nov19.pdf [Accessed on 11 November 2019].

- Amiti, M., Redding, S. J. and Weinstein, D., 2019. The Impact of the 2018 Trade War on US. Prices and Welfare. National Bureau of Economic Research. DOI: 10.3386/w25672.

- Buchholz, K., 2019. The U.S.-China Trade Deficit is Growing. Statista. [online] Available at: https://www.statista.com/chart/15419/the-us-trade-balance-with-china/ [Accessed on 11 November 2019].

- Cerutti E., Chen S., Deb P., Gjonbalaj A., Hannan S.A. and Adil Mohommad A., 2019. Managed Trade: What Could be Possible Spillover Effects of a Potential Trade Agreement Between the U.S. and China?. IMF Working Paper. https://www.imf.org/~/media/Files/Publications/WP/2019/wpiea2019251-print-pdf.ashx [Accessed on 11 November 2019].

- Daniels, J., Radebaugh, L. and Sullivan, D., 2017. International Business. Environment & Operations. 16th Edition. New York: Pearson.

- Dobson, J., 1976. Two Centuries of Tariffs. The Background and Emergence of the U.S. International Trade Commission. U.S. Government Printing Office: Washington, D.C. [online] Available at: https://www.usitc.gov/publications/other/pub0000.pdf [Accessed on 11 November 2019].

- Encyclopædia Britannica, 2018. Smoot-Hawley Tariff Act. [online] Available at: https://www.britannica.com/topic/Smoot-Hawley-Tariff-Act [Accessed on 11 November 2019].

- European Commission, 2018. EU adopts rebalancing measures in reaction to US steel and aluminum tariffs. [online] Available at: http://trade.ec.europa.eu/doclib/press/index.cfm?id=1868 [Accessed on 11 November 2019].

- Federal Register, 2019. Addition of Certain Entities to the Entity List and Revision of Entries on the Entity List. Bureau of Industry and Security, Commerce. [online] Available at: https://www.federalregister.gov/documents/2019/08/21/2019-17921/addition-of-certain-entities-to-the-entity-list-and-revision-of-entries-on-the-entity-list [Accessed on 11 November 2019].

- Fraser Institute, 2018. Economic Freedom. [online] Available at: https://www.fraserinstitute.org/economic-freedom/map?geozone=world&page=map&year=2017&countries=USA [Accessed on 11 November 2019].

- Friedman, M., 2009. Free to choose. (Romanian version). Bucharest, Romania: Publica.

- Fukuyama, F., 1992. The End Of History and the Last Man. New York: Macmillan [online] Available at: http://aps-m.org/wp-content/uploads/2017/03/The-End-of-History-and-the-Last-Man-Francis-Fukuyama-1992.pdf [Accessed on 11 November 2019].

- Hanemann, T. and Gao, C., 2015. Chinese FDI in the United States: Q4 and Full Year 2014 Update. Rhodium Group [online] Available at: https://rhg.com/research/chinese-fdi-in-the-united-states-q4-and-full-year-2014-update/ [Accessed on 11 November 2019].

- Hanemann, T. and Gao, C., 2016. Chinese FDI in the US: 2015 Recap. Rhodium Group [online] Available at: https://rhg.com/research/chinese-fdi-in-the-us-2015-recap/ [Accessed on 11 November 2019].

- Hanemann, T., Gao, C. and Lysenko, A., 2019. Net Negative: Chinese Investment in the US in 2018. Rhodium Group. [online] Available at: https://rhg.com/research/chinese-investment-in-the-us-2018-recap/ [Accessed on 11 November 2019].

- Hanemann, T., Rosen, D.H., Gao, C. and Lysenko, A., 2019. Two-Way Street: 2019 Update US-China Direct Investment Trends. Rhodium Group. [online] Available at: https://rhg.com/research/two-way-street-2019-update-us-china-direct-investment-trends/ [Accessed on 11 November 2019].

- Hayek, F., 2006. The Road to Serfdom. (Romanian version). Bucharest, Romania: Humanitas.

- Keynes, J.M., 1933. The means to prosperity. London: Macmillan and Co.

- Mises, L., 1998. Human Action. A Treatise On Economics. Auburn, Alabama: Ludwig von Mises Institute.

- Mises, L., 2012. Liberalism: In the Classical Tradition. (Romanian version). Iasi, Romania: Alexandru Ioan Cuza University Press.

- Nicita, A., 2019. Trade and trade diversion effects of United States tariffs on China. UNCTAD Research Paper No. 37. [online] Available at: https://unctad.org/en/PublicationsLibrary/ser-rp-2019d9_en.pdf [Accessed on 11 November 2019].

- OECD, 2008. The 2008 G-20 Washington DC Summit. [online] Available at: http://www.oecd.org/g20/summits/washington-dc/ [Accessed on 11 November 2019].

- Park, S.C., 2018. U.S. Protectionism and Trade Imbalance between the U.S. and Northeast Asian Countries. International Organisations Research Journal, 13(2), pp.76-100. DOI: 10.17323/1996-7845-2018-02-05

- Ricardo, D., 2001. On the Principles of Political Economy and Taxation. Ontario, Canada: Batoche Books Kitchener.

- Samuelson, P. and Nordhaus, W., 2001. Economics. (Romanian version). Bucharest, Romania: Teora.

- Schumpeter, J.A., 2003. Capitalism, Socialism & Democracy. London, UK: Routledge.

- Smith, A., 2007. An Inquiry Into the Nature and Causes of the Wealth Of Nations. ΜεταLibri Digital Library [online] Available at: https://www.ibiblio.org/ml/libri/s/SmithA_WealthNations_p.pdf [Accessed on 11 November 2019].

- The State Council, 2019. The People’s Republic of China. [online] Available at: http://english.www.gov.cn/statecouncil/ministries/page_1.html [Accessed on 11 November 2019].

- The White House, 2015. Statement by the President on the Trans-Pacific Partnership. Office of the Press Secretary. [online] Available at: https://obamawhitehouse.archives.gov/the-press-office/2015/10/05/statement-president-trans-pacific-partnership [Accessed on 11 November 2019].

- The White House, 2018. President Donald J. Trump is Confronting China’s Unfair Trade Policies [online] Available at: https://www.whitehouse.gov/briefings-statements/president-donald-j-trump-confronting-chinas-unfair-trade-policies/ [Accessed on 11 November 2019].

- The White House, 2018. President Donald J. Trump is Keeping His Promise to Renegotiate NAFTA. Fact sheets. [online] Available at: https://www.whitehouse.gov/briefings-statements/president-donald-j-trump-keeping-promise-renegotiate-nafta/ [Accessed on 11 November 2019].

- The World Bank, 2019. World Bank Data [online] Available at: https://data.worldbank.org/ [Accessed on 11 November 2019].

- U.S. Chamber of Commerce, 2017. The Facts on NAFTA. Assessing Two Decades of Gains in Trade, Growth, and Jobs. [online] Available at: https://www.uschamber.com/sites/default/files/the_facts_on_nafta_-_2017.pdf [Accessed on 11 November 2019].

- U.S. Department of the Treasury, 2018. Summary of the Foreign Investment Risk Review Modernization Act of 2018. [online] Available at: https://www.treasury.gov/resource-center/international/Documents/Summary-of-FIRRMA.pdf [Accessed on 11 November 2019].

- UNCTAD, 2019. World Investment Report 2019. New York: United Nations Publication [online] Available at: https://unctad.org/en/PublicationsLibrary/wir2019_en.pdf [Accessed on 11 November 2019].

- USTR, 2018. European Union. U.S.- EU Trade Facts. [online] Available at: https://ustr.gov/countries-regions/europe-middle-east/europe/european-union [Accessed on 11 November 2019].

- USTR, 2018. The People's Republic of China. U.S.-China Trade Facts. [online] Available at: https://ustr.gov/countries-regions/china-mongolia-taiwan/peoples-republic-china [Accessed on 11 November 2019].

- USTR, 2019. China Section 301-Tariff Actions and Exclusion Process. [online] Available at: https://ustr.gov/issue-areas/enforcement/section-301-investigations/tariff-actions [Accessed on 11 November 2019].

- USTR, 2019. United States and China Reach Phase One Trade Agreement. [online] Available at: https://ustr.gov/about-us/policy-offices/press-office/press-releases/2019/december/united-states-and-china-reach [Accessed on 11 November 2019].

- WTO, 2019. European Communities and Certain member States - Measures Affecting Trade in Large Civil Aircraft [online] Available at: https://www.wto.org/english/tratop_e/dispu_e/cases_e/ds316_e.htm [Accessed on 11 November 2019].

- Yalcin, E., Felbermayr, G. and Kinzius, L., 2017. Hidden Protectionism: Non-Tariff Barriers and Implications for International Trade. Munich: Ifo Institute for Economic Research. [online] Available at: https://www.cesifo-group.de/DocDL/ifo_Forschungsberichte_91_2017_Yalcin_etal_Protectionism.pdf [Accessed on 11 November 2019].

Article Rights and License

© 2020 The Authors. Published by Sprint Investify. ISSN 2359-7712. This article is licensed under a Creative Commons Attribution 4.0 International License.